The Ultimate Forex Trading Simulator: Your Path to Mastering the Markets

In today’s fast-paced financial environment, understanding forex trading has become more critical than ever. For both beginners and seasoned traders, a forex trading simulator offers a valuable opportunity to practice trading strategies, analyze market trends, and hone decision-making skills without the risk of losing real money. Even if you’re new to the field, you can leverage a forex trading simulator Trading Brokers in Turkey for insights into the local markets and practices.

What is a Forex Trading Simulator?

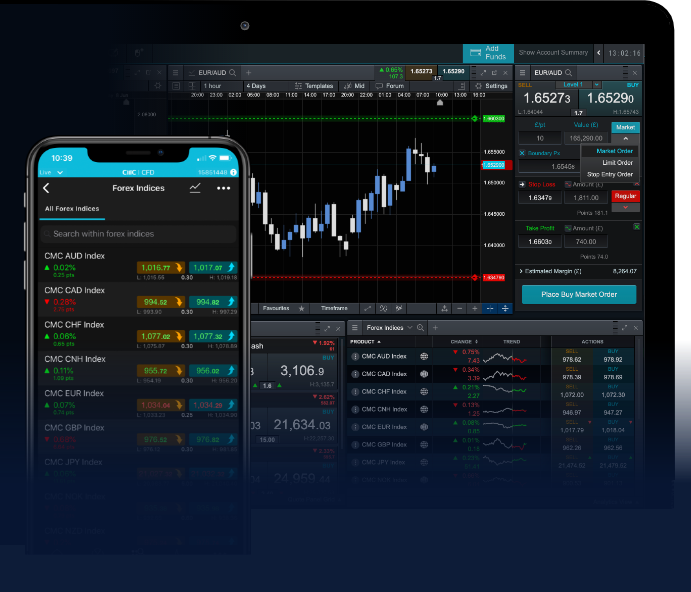

A forex trading simulator is a software program that allows traders to execute trades in a simulated environment. These platforms provide real-time market data, allowing users to make trades as if they were in a real trading scenario. Most simulators come equipped with various tools to analyze market conditions, study currency pairs, and track the performance of trades over time.

Importance of Using a Forex Trading Simulator

Using a forex trading simulator is essential for several reasons:

- Risk-Free Environment: Simulators provide a way to trade without the financial risk associated with real trading. This safety net enables new traders to make mistakes and learn from them.

- Strategy Development: Traders can test different trading strategies in a risk-free setting. Whether experimenting with day trading, swing trading, or scalping, simulators enable traders to analyze outcomes without the financial fallout.

- Emotional Control: Trading psychology plays a significant role in a trader’s success. A simulator helps users manage emotions like fear and greed when executing trades since no actual money is at stake.

- Understanding Market Dynamics: Simulators often replicate real market conditions, granting users an understanding of how various economic factors influence currency prices.

Features of a Forex Trading Simulator

The functions of a forex trading simulator can vary depending on the platform, but here are some of the most valuable features to consider:

- Real-Time Market Data: Access to live price feeds allows traders to perform trades like they do in the real forex market.

- Analysis Tools: Advanced charting tools, technical indicators, and drawing tools enable in-depth market analysis.

- Customizable Settings: Users can often set their own trading parameters, such as risk levels, leverage, and lot sizes, to cater to their individual trading style.

- Performance Tracking: Simulators provide analytics that enable users to review their trading history, learn from mistakes, and identify successful strategies.

How to Choose the Right Forex Trading Simulator

Selecting the right forex trading simulator can profoundly impact your learning experience. Here are a few factors to keep in mind:

- Usability: The interface should be user-friendly and accessible, allowing traders of all levels to navigate the platform with ease.

- Realism: Look for simulators that provide realistic trading conditions, including slippage, spread variations, and the ability to trade during market hours.

- Cost: While many simulators are available for free, some platforms may charge fees. It’s important to assess whether the features offered justify the cost.

- Community and Support: A vibrant community and access to customer support can enhance your learning experience, with opportunities for networking and seeking advice from more experienced traders.

Getting Started with a Forex Trading Simulator

Once you’ve chosen a simulator, the next step is to get started. Here’s a general guideline:

- Set Up Your Account: Register for an account on the simulator of your choice.

- Familiarize Yourself with the Interface: Before diving into trading, take some time to explore the platform’s features and tools.

- Develop a Trading Plan: Having a clear trading strategy is crucial, so outline your plan, including risk management and profit targets.

- Start Practicing: Begin executing trades based on your strategy, applying what you’ve learned about market trends and conditions.

- Review and Adjust: After conducting trades, assess what worked and what didn’t, making necessary adjustments to your strategy.

Conclusion

In conclusion, a forex trading simulator is an invaluable tool for anyone looking to enhance their trading skills without the financial risk commonly associated with trading in live markets. By providing a space to practice strategies, understand market dynamics, and refine trading psychology, simulators empower traders to advance their skills. With diligence and consistency, you can utilize a simulator to cultivate the foundations of successful trading and prepare for your journey in the complex world of forex trading.