In the dynamic world of forex trading, having an edge can make all the difference. This is where

forex swing trading signals Trading Broker CI comes into play. By utilizing forex swing trading signals, traders can potentially optimize their profits and minimize risks. In this article, we explore the essence of forex swing trading signals, their advantages, and how to effectively implement them in your trading strategy.

What is Forex Swing Trading?

Swing trading is a popular trading style that focuses on capturing short to medium-term gains in a financial instrument over a period of a few days to several weeks. Unlike day trading, which requires constant monitoring of price movements, swing trading allows traders to take a step back and make more calculated decisions based on market trends and signals.

Understanding Forex Swing Trading Signals

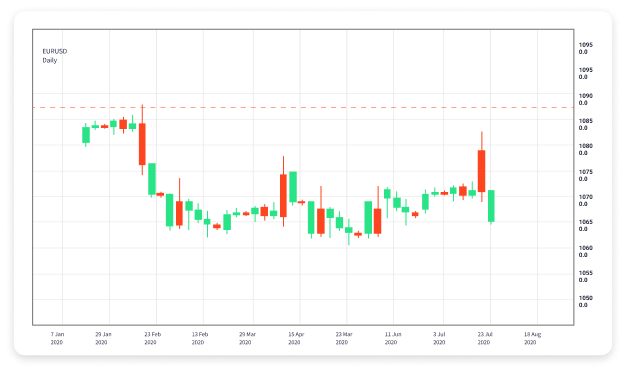

Forex swing trading signals are indicators generated by analyzing market trends. These signals help traders identify potential entry and exit points in the market. They can be based on a variety of factors, including technical analysis, fundamental analysis, or a combination of both.

Traders often use various tools and indicators to generate these signals. Commonly used indicators include Moving Averages, Relative Strength Index (RSI), and Fibonacci retracements. Each of these tools provides valuable insights into market behavior and can help traders make more informed decisions.

Benefits of Using Forex Swing Trading Signals

1. **Time Efficiency**: One of the main advantages of swing trading signals is the time they save for traders. Unlike day trading, which requires constant monitoring, swing trading signals allow traders to plan their trades without being glued to the screen.

2. **Reduced Stress**: Swing trading is generally less stressful than day trading, as traders are not forced to react quickly to rapid market changes. This makes it a suitable option for individuals who have other commitments or prefer a more relaxed trading style.

3. **Focused Strategy**: Forex swing trading encourages traders to focus on a few key positions, allowing for a more concentrated strategy. This focus can lead to better decision-making and improved outcomes.

Implementing Forex Swing Trading Signals

To effectively use forex swing trading signals, it’s essential to follow a structured approach. Here are some tips:

1. Choose Reliable Signal Sources

Not all trading signals are created equal. It’s essential to choose reliable sources for your signals. This may involve utilizing professional trading tools, subscribing to signal services, or following experienced traders. Research and testimonials can provide insights into the reliability of signal providers.

2. Backtesting Signals

Before committing real money, backtest the signals to see how they would have performed in previous market conditions. This process helps in evaluating the effectiveness of specific trading signals and allows traders to make informed decisions.

3. Combine Technical and Fundamental Analysis

While technical indicators are vital, integrating fundamental analysis can enhance your trading strategy. Economic news releases, interest rate changes, and geopolitical events can significantly impact currency prices, which should inform your trading decisions.

4. Manage Risk Wisely

Risk management is crucial in forex trading. Set appropriate stop-loss orders to protect your capital. By determining your risk tolerance, you can better manage your trades and avoid significant losses.

Common Mistakes to Avoid

While using forex swing trading signals, traders must be aware of common pitfalls. Here are a few mistakes to avoid:

1. **Overtrading**: Some traders may feel compelled to act on every signal they receive. This can lead to poor decision-making and increased transaction costs. It’s important to select quality trades over quantity.

2. **Ignoring Market Conditions**: Signals may not always reflect the current market conditions. Traders should consider external factors that could affect the market before executing trades based solely on signals.

3. **Lack of a Trading Plan**: Entering the market without a well-defined trading plan can lead to impulsive decisions. Establishing a plan that includes your trading goals, risk management strategies, and methods for evaluating signals can help maintain discipline.

Conclusion

Forex swing trading signals can be a powerful tool in a trader’s arsenal. By understanding how to interpret and implement these signals effectively, traders can enhance their chances of success. Remember to combine signals with solid risk management strategies and consider broader market conditions for a holistic trading approach. Whether you are a novice trader or someone looking to refine your techniques, mastering forex swing trading signals can open the door to new trading opportunities.